The EUR/USD currency pair maintained its bearish tone on Wednesday and took a brief pause on Thursday. On Wednesday evening, we witnessed another surge in the U.S. dollar, which was once again fully justified and logical. The U.S. central bank left all monetary policy parameters unchanged, but Jerome Powell also refrained from hinting at any readiness to cut rates in September. This is the essence of the matter.

The market has been anticipating aggressive monetary policy easing since 2022, when U.S. inflation began to slow from its peak levels. For example, in 2024, when the Fed started cutting the key rate, the market expected 6–7 rounds of easing at 0.25% each. For 2025, expectations were reduced to four rounds, then two, and now — if the Federal Reserve cuts rates even once, that will be seen as a success. Thus, the market continues repeating the same behavior: expecting the most dovish outcome, only to be disappointed by its forecasts.

On Wednesday evening, traders were certainly hoping that Powell would announce the Fed's readiness to resume easing at the next meeting. However, we have repeatedly stated that the Fed will continue to base its decisions on the inflation data. And that's not just our opinion — it's the view held by Powell himself and the entire FOMC. Yes, recently there has been a division within the committee, not so much because of differing views, but because some officials are eyeing Powell's position and want to show Donald Trump that they're willing to cut rates to any level, at the first call from the White House.

The officials who are not seeking the Fed Chair position continue to vote against easing at every meeting. They are acting within their mandates. The Fed's primary mandate is price stability. The second most important mandate is full employment. The U.S. labor market has shown no significant deterioration in recent months. On the contrary, the latest unemployment and Nonfarm Payrolls reports have come in better than expected. Meanwhile, inflation is rising — and according to Powell, it will continue to accelerate as Trump's tariffs are only just starting to impact the economy.

Moreover, if Trump had already finalized the tariff lists for all trading partners, some inflation forecasts could be made. But only this week, Trump imposed tariffs on India and Brazil, signed a trade deal with South Korea (which also includes tariffs), and starting today, copper and pharmaceutical imports into the U.S. will be taxed at rates of 50% and 200%. Therefore, the average tariff rate on U.S. imports continues to rise, and there is every reason to believe that inflation will continue to grow. That's why we seriously doubt the Fed will cut the key rate even once before the end of the year. For the U.S. dollar, this is a bullish factor, and the economy under Trump has indeed begun to grow. As a result, the U.S. currency has a fundamental basis for further appreciation, although on the daily timeframe, this still appears to be a downward correction.

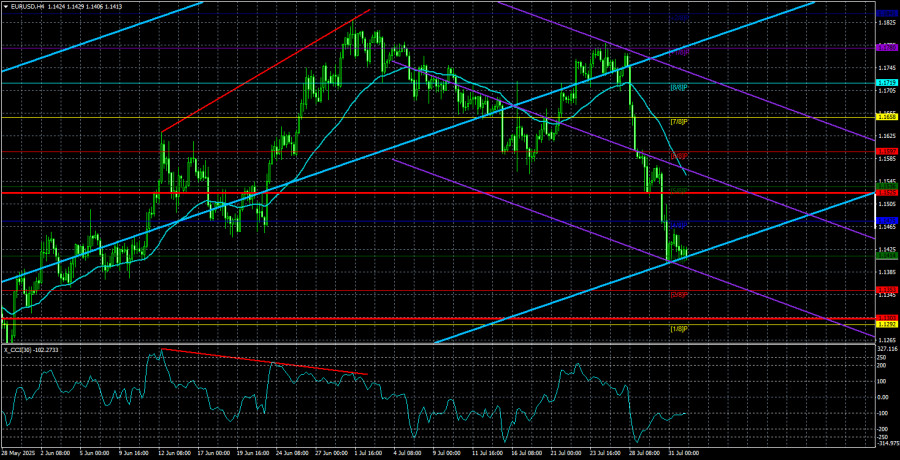

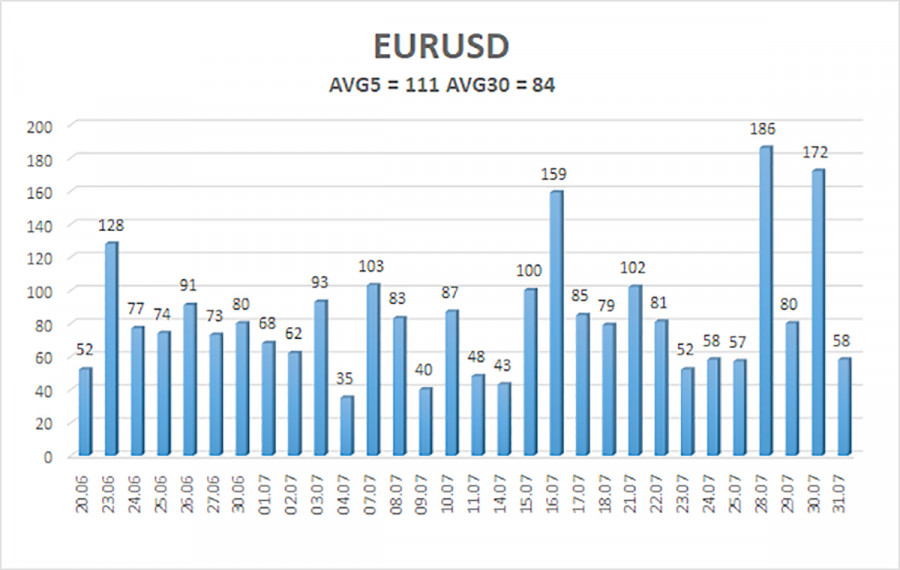

The average volatility of the EUR/USD currency pair over the last five trading days as of August 1 is 111 pips, which is considered "high." We expect the pair to move between the levels of 1.1303 and 1.1525 on Friday. The long-term linear regression channel is pointing upward, which still signals an uptrend. The CCI indicator has entered oversold territory for the third time, once again warning of a potential resumption of the uptrend.

Nearest Support Levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair is continuing a new phase of corrective movement. U.S. domestic and foreign policy under Trump remains the dominant force influencing the dollar. This week, the dollar strengthened, but from our perspective, this does not signal medium-term buying opportunities. If the price stays below the moving average, short positions may be considered with targets at 1.1353 and 1.1303. If the price rises above the moving average line, long positions remain relevant with targets at 1.1719 and 1.1780 in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.