Trade Analysis and Tips for Trading the British Pound

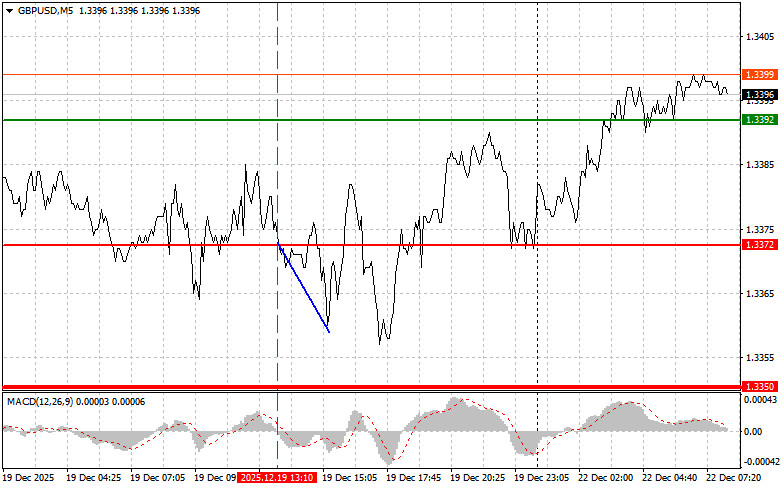

The test of the price at 1.3372 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair decreased by 15 pips.

The pound reacted poorly to the retail sales data. Weak UK retail sales raised concerns about consumer activity; however, their impact was mitigated by similar signals from the U.S. economy. The University of Michigan consumer sentiment index, reflecting worries about inflation and economic uncertainty, raised doubts about the strength of the U.S. recovery, putting pressure on the dollar.

This morning, important data on the dynamics of UK GDP for the third quarter of the current year, changes in investment volumes, and current account balance figures are expected to be published. These economic indicators are under close scrutiny by traders as they provide relevant insights into the state of the British economy following a period of significant instability and economic upheaval. The GDP dynamics for the third quarter will serve as a key indicator to assess how successfully the UK is coping with high inflation and high rates. If the British GDP declines for a second consecutive quarter, the British pound may weaken against the U.S. dollar. Changes in investment volume in the UK, which play a key role in long-term economic growth, will also be in focus. An increase in investment could signal strengthened business confidence and a willingness to expand and innovate, thereby stimulating economic growth and job creation. The current account balance reflects the difference between export earnings and import expenditures. A negative balance may indicate that the country spends more than it earns, which could lead to a weakening of the national currency and other economic difficulties.

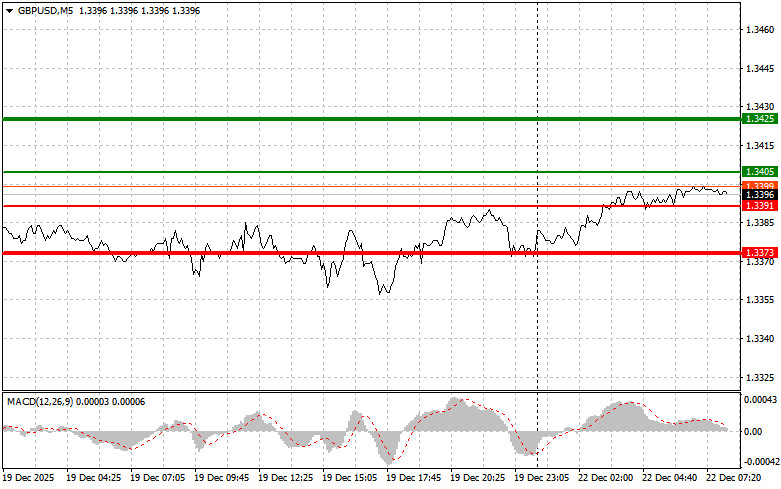

In terms of intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the pound today when it reaches the entry point around 1.3405 (green line on the chart), targeting a move to 1.3425 (thicker green line on the chart). At approximately 1.3425, I will exit my long positions and sell immediately on a pullback, anticipating a movement of 30-35 pips back from the entry point. Strong pound growth can only be expected after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3391 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to opposing levels of 1.3405 and 1.3425 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3391 level is updated (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3373 level, where I intend to exit my short positions and immediately buy in the opposite direction, anticipating a 20-25-pip move back from that level. Sellers of the pound are likely to return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3405 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline to opposing levels of 1.3391 and 1.3373 can be expected.

What to Look for on the Chart:

- Thin Green Line – entry price for buying the trading instrument;

- Thick Green Line – indicative price where Take Profit can be set, or profits can be locked in, as further growth above this level is unlikely;

- Thin Red Line – entry price for selling the trading instrument;

- Thick Red Line – indicative price where Take Profit can be set, or profits can be locked in, as further declines below this level are unlikely;

- MACD Indicator – It is important to be guided by overbought and oversold zones when entering the market.

Important: Beginner traders in the Forex market should make entry decisions cautiously. It is advisable to stay out of the market ahead of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you are trading large volumes without proper money management.

Remember that successful trading requires a clear trading plan, as in the example above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.