Analysis of Trades on Wednesday:

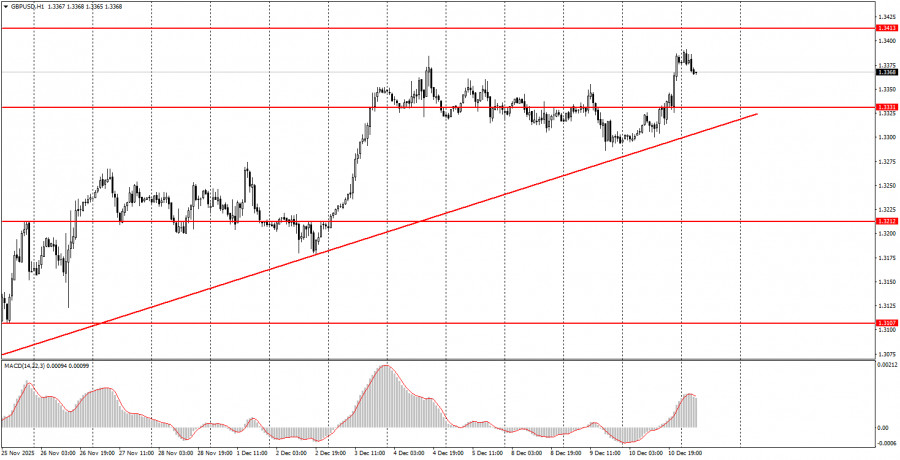

1H Chart of the GBP/USD Pair

The GBP/USD pair also traded higher on Wednesday, with a similar fundamental backdrop. However, it should be noted that the British currency began to rise well before the publication of the Federal Reserve's decision on rates and Jerome Powell's speech. Thus, as we anticipated, the upward trend for the British pound is maintained and gaining momentum. The market finally responded to the Fed's monetary easing as expected—by selling the dollar. Even the announcement of a pause in rate cuts at the beginning of 2026 did not deter traders from disposing of US currency. We have long anticipated a resumption of the global upward trend and believe there are still no fundamental grounds for the dollar's medium-term growth. The fact that the pair rose yesterday based on a generally "dovish" decision and "neutral" assurances is a very good sign for further upward movement. The pair has corrected for five months, and we believe this is sufficient.

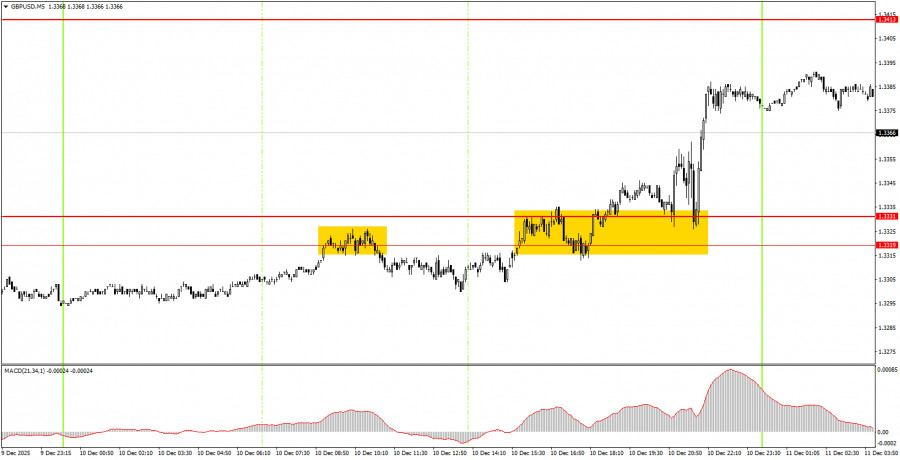

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, several interesting trading signals were formed on Wednesday. Initially, the pair bounced in the 1.3319-1.3331 range, but this signal did not develop, as the price failed to drop by 20 pips. However, during the U.S. trading session, the price broke through the 1.3319-1.3331 range, allowing novice traders to open long positions in advance. At the time of the FOMC announcement, traders could position their Stop Losses near the entry point and wait for developments. Subsequently, the pair showed strong growth.

How to Trade on Thursday:

On the hourly timeframe, the GBP/USD pair continues to form a local upward trend. As we mentioned, there are no global factors driving medium-term dollar growth, so we expect movement only to the upside. Overall, we anticipate the resumption of the global upward trend in 2025, which could push the pair to 1.4000 within the next couple of months.

On Thursday, novice traders can remain in long positions based on yesterday's buy signals. The target is 1.3413. New long positions can be considered upon a bounce from the area of 1.3319-1.3331. Short positions should be considered if the price settles below the area of 1.3319-1.3331, targeting 1.3259-1.3267.

On the 5-minute timeframe, levels to consider include 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3212, 1.3259-1.3267, 1.3319-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. There are no significant events scheduled in the UK or the US on Thursday, but the FOMC meeting results may still influence the market. Overall, upward movement in the pair remains a more attractive option than decline.

Key Rules of the Trading System:

- The strength of a signal is assessed by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near any level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can create numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades are opened during the period between the start of the European session and the middle of the American session, after which all trades must be closed manually.

- On the hourly timeframe, when trading based on signals from the MACD indicator, it is preferable to trade only when good volatility is present, and a trend is confirmed by a trend line or channel.

- If two levels are positioned too closely to each other (5 to 20 points), they should be viewed as a support or resistance area.

- After moving 20 pips in the right direction, set the Stop Loss to breakeven.

Chart Explanation:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction for trading.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.